In today's rapidly evolving financial landscape, businesses are constantly seeking innovative solutions to optimize cash flow and access 資金調達. One such innovation is OMM for AR, a groundbreaking platform designed to facilitate the buying and selling of accounts receivable. By leveraging an auction-style transaction model, this platform provides a fair and transparent marketplace for businesses to raise funds and investors to explore lucrative opportunities.

What is OMM for AR?

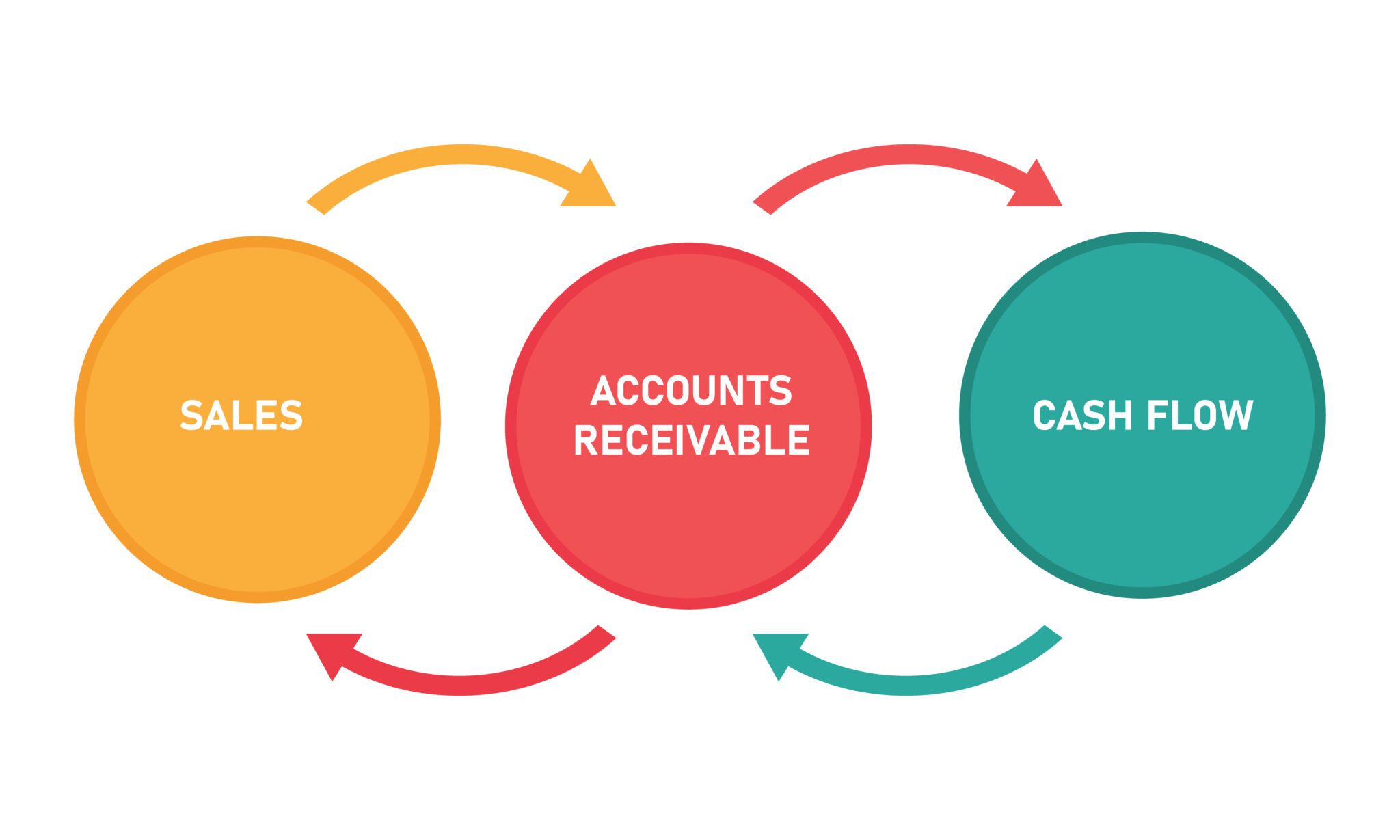

OMM for AR stands for "Open Market Mechanism for Accounts Receivable." It is a unique platform that connects businesses in need of immediate cash flow with buyers interested in purchasing accounts receivable (A/R). Essentially, it is a modern approach to ファクタリング, the financial process where businesses sell their invoices at a discount to receive early payments.

Unlike traditional factoring services, which often involve complex negotiations and opaque pricing, OMM for AR introduces a transparent, auction-based model. Sellers list their accounts receivable on the platform, and buyers bid on them. This competitive process ensures fair market pricing, benefiting both parties.

The Importance of Accounts Receivable Funding

売掛債権 represent outstanding payments owed by customers to a business. While these unpaid invoices are an asset on the balance sheet, they can pose a significant challenge for cash flow management. Delays in receiving payments often lead to liquidity issues, hindering a business's ability to meet operational expenses, invest in growth, or respond to emergencies.

Accounts receivable funding through factoring addresses this challenge by converting unpaid invoices into immediate cash. This process enables businesses to:

- Improve liquidity: Access cash without waiting for customer payments.

- Support growth: Fund new projects or expansions without taking on traditional debt.

- Streamline operations: Focus on core activities without the administrative burden of chasing payments.

How OMM for AR Stands Out

Traditional factoring often lacks transparency and can involve high fees, fixed terms, and lengthy processes. OMM for AR disrupts this norm with a more flexible and accessible model:

- Auction-Style Transactions: Sellers list their accounts receivable on the platform, and buyers bid competitively. This dynamic pricing mechanism ensures sellers receive fair value while buyers secure attractive returns.

- Transparency: OMM for AR fosters trust by providing detailed information about the invoices and participants, enabling informed decision-making.

- Accessibility: The platform is designed to be user-friendly, allowing businesses of all sizes to participate and access funding efficiently.

- Flexibility: Sellers can choose which invoices to sell, and buyers can diversify their investment portfolios by purchasing invoices from various industries.

Benefits for Sellers and Buyers

For Sellers

- Immediate Cash Flow: Quickly unlock funds tied up in unpaid invoices.

- No Additional Debt: Unlike loans, factoring does not add liabilities to the balance sheet.

- Customizable Options: Select specific invoices to sell, retaining control over the transaction.

For Buyers

- Attractive Returns: Earn profits by purchasing invoices at a discount and collecting full payments later.

- Diversification: Invest in accounts receivable from different industries and regions.

- Risk Management: Use detailed invoice and seller information to assess and mitigate risks.

How OMM for AR Ensures Fairness and Security

Transparency and trust are the cornerstones of OMM for AR. The platform incorporates rigorous measures to ensure fair and secure transactions:

- Verification Processes: Both buyers and sellers undergo thorough vetting to maintain the platform's integrity.

- Data Security: Robust encryption protocols protect sensitive financial information.

- Performance Metrics: Buyers can evaluate sellers based on payment histories and ratings, enabling informed decisions.

- Dispute Resolution: A dedicated support team is available to resolve disputes promptly and fairly.

Why Choose OMM for AR?

For businesses, OMM for AR offers a lifeline to navigate cash flow challenges without resorting to traditional debt instruments. For buyers, it opens a new avenue for investment with manageable risks and potentially high returns.

Whether you are a small business owner seeking immediate liquidity or an investor looking to diversify your portfolio, OMM for AR provides a robust and transparent platform to meet your needs.

Final Thoughts

As the financial landscape evolves, platforms like OMM for AR are setting new standards for fairness, transparency, and efficiency in accounts receivable funding. By bringing sellers and buyers together in an innovative auction-based marketplace, OMM for AR not only democratizes access to funding but also empowers businesses and investors alike to achieve their goals.

Explore the future of factoring with OMM for AR and unlock the potential of your accounts receivable.

For more information, visit omm-for-ar.com.